URGENTE

- Ирвин казино мобильная версия официальный сайт Irwin casino

- Ирвин казино регистрация

- Онлайн казино Ирвин. Зеркало казино Irwin. Личный кабинет, регистрация, игровые автоматы

- Игровые аппараты демо версии Аркада Казино

- Игровые аппараты демо версии Аркада Казино

- Аркада казино регистрация

- Играть слоты гараж бесплатно Банда Казино

- Бонусы онлайн казино Banda Casino (Банда)

- Банда казино рабочее зеркало

- Почему Отказывают В Выплате Dragon Money?

- Dragon Money Зеркало ᐈ Вход На Официальный Сайт Драгон Мани

- Бонусы казино Банда, промо, турниры

- Играй в Уникальном Стиле: Банда Казино Ждет Тебя!

- Бонусы казино Банда

- Банда казино играть на деньги! Мобильная версия доступна уже!

- Казино Банда (Banda) официальный сайт, войти через рабочее зеркало

- Играть бесплатно в Space на Комета Казино

- Игровые автоматы бесплатно лягушка Комета Казино

- Официальный Сайт Комета Казино Casino Kometa: Регистрация, Вход И Бонусы ️ Играть Онлайн На Официальном Сайте Kometa Casino

- Онлайн Казино Банда. Зеркало Казино Banda. Личный Кабинет, Регистрация, Игровые Автоматы

- Banda Casino Зеркало – Рабочие Зеркало На Сегодня Банда Казино

- Banda Casino Зеркало – Рабочие Зеркало На Сегодня Банда Казино

- Как Выиграть Банда Казино?

- Комета Казино – Вход На Сайт, Личный Кабинет, Бонусы За Регистрацию, Лучшие Слоты На Деньги И Бесплатно В Демо-Режиме

- Комета Казино Онлайн

- Комета Казино – вход на сайт, личный кабинет, бонусы за регистрацию, лучшие слоты на деньги и бесплатно в демо-режиме

- On the web Black-jack Enjoy Blackjack On the web

- Закачать 1xBet на Дроид безвозмездно APK обложка: официальное приложение нате android 2024

- Higher Restriction Black-jack Gamble On the internet Blackjack from the 888casino

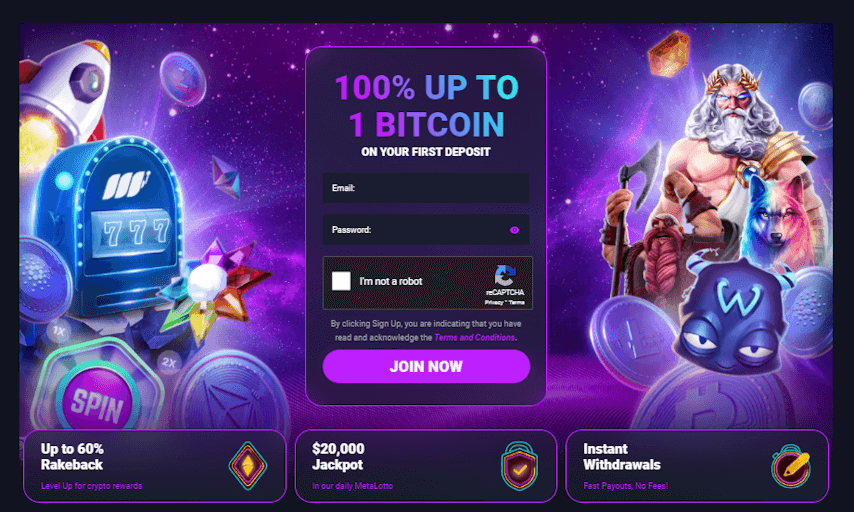

- Better Online casinos 2025

- Tipobet Casino Giri Tipobet Gncel Giri 2025 Tipobet Tipobet Tipobet giri Tipobet giris Tipobet yen.24549